With the current recession and higher and higher unemployment rates, it's time for networking and flexbility in finding a job. Employers too are trying to be adaptable and find new ways of recruiting. The jobs will go to those individuals who are willing to think outside-the-box.

Tuesday, April 21, 2009

Monday, April 20, 2009

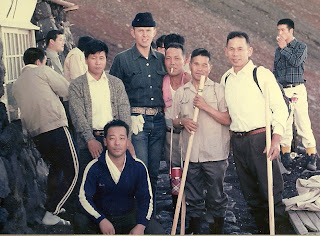

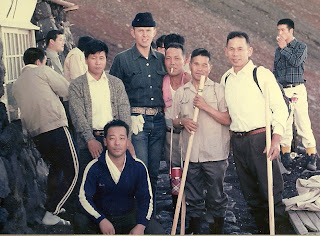

Climbing Mt. Fuji in Japan 1972

I was sending out some random emails tonight and came across some pictures of me in the army in 1972. I'm going to go ahead and post it today even though it was 37 years ago. No one will probably ever read my blog back to the beginning and I doubt they'd go back that far.

These are a couple of pictures of us stopping on the way up and resting. I'd gone to Japan while I was stationed in Korea on the demilitarized zone. My best friend John Bradley and I had decided to make the climb of the 14,000 foot peak.

And then after we had climbed all day long, we stopped and spent the night at the 13,000 foot level and got up early to finish the climb to the top of the crater and watch the sunrise. By the time the sun did come up, the clouds had moved in off the ocean and we were so high that we were above the clouds. When John took the picture of me we didn't realize that it would come back looking like I was standing on top of the clouds. I guess for a moment I was super man!

And then after we had climbed all day long, we stopped and spent the night at the 13,000 foot level and got up early to finish the climb to the top of the crater and watch the sunrise. By the time the sun did come up, the clouds had moved in off the ocean and we were so high that we were above the clouds. When John took the picture of me we didn't realize that it would come back looking like I was standing on top of the clouds. I guess for a moment I was super man!

Saturday, April 18, 2009

The Train and the Kitchen Bitch

A mother was working in the kitchen listening to her 5-year-old son playing with his new electric train in the living room. She heard the train stop and her son saying, "All of you sons-of-bitches who want off, get the hell off now ... cause this is the last stop! And all of you sons- of-bitches who are getting on, get your asses on the train ... cause we're going down the tracks. The horrified mother went in and told her son, "We don't use that kind of language in this house. Now I want you to go to your room and you are to stay there for TWO HOURS. When you come out, you may play with your train ... but I want you to use nice language."

Two hours later, the son came out of the bedroom and resumed playing with his train. Soon the train stopped and the mother heard her son say. "All passengers, please remember your things, thank you and hope your trip was a pleasant one. We hope you will ride with us again soon." She heard her little darling continue...

"For those of you just boarding, remember, there is no smoking in the train. We hope you will have a pleasant and relaxing journey with us today." As the mother began to smile, the child added, "For those of you who are pissed off about the TWO HOUR delay, please see the bitch in the kitchen...."

Two hours later, the son came out of the bedroom and resumed playing with his train. Soon the train stopped and the mother heard her son say. "All passengers, please remember your things, thank you and hope your trip was a pleasant one. We hope you will ride with us again soon." She heard her little darling continue...

"For those of you just boarding, remember, there is no smoking in the train. We hope you will have a pleasant and relaxing journey with us today." As the mother began to smile, the child added, "For those of you who are pissed off about the TWO HOUR delay, please see the bitch in the kitchen...."

Thursday, April 16, 2009

Ten Reasons for lacking financial success.

Ten reasons that I have discovered that often times hinders me achieving the financial success that I want:

You feel entitlement: If you believe you deserve to live a certain lifestyle, have certain things and spend a certain amount before you have earned to live that way, you will have to borrow money. That large chunk of debt will keep you from building wealth. The world, the government, your boss, and no one else owes you a thing. With the rare exception of a few folks who inherited wealth, most people who have more than you have worked harder, saved more, and spent smarter than you have. Take some responsibility for youself and make a decision to do something to move forward. A man, who was one time appreciating a house that I was building (and paying cash for) told me that he wished he could have a house someday like mine. I asked him why he didn't think he would. And he said "are you crazy? I could never have enough money to have a house like this.". I told him that wasn't the problem. The problem was that he wasn't willing to "pay the price". And the price was not measured in $$$$. The price was measured in the fact that I was willing to work 50 or 55 or 60 hours a week to earn extra money to pay cash for something. Whereas he was primarily focused on how soon 5 o'clock would arrive so that he could get off and go get a beer. I deserved the house I was building. He didn't.

You care what your car looks like: A car is a means of transportation to get from one place to another, but many people don't view it that way. Instead, they consider it a reflection of themselves and spend money every two years or so to feel better about themselves or to impress others instead of driving the car for its entire useful life and investing the money saved. I drive a seven year old nice car that still runs wonderful, is very comfortable, and has 145,000 miles on it. My car payment is zero and I am just as comfortable in it as I would be in a car that was new or that I was making payments on. A car . . .unless it is a collector or toy . . .has no value other than to get you from Point A to Point B and perhaps to do it in some measure of comfort. Most cars lose money every day that you own them. Now . . I am not throwing stones at anyone. I have had nice cars before. But I wish now I had the money back that I lost on owning them. They didn't get me anywhere I was wanting to go any faster or more comfortably than the 7 year old Toyota I have now. I've also had two expensive collector cars that were sports cars. I did not buy them for status. I bought them for fun. I don't do many other things for entertainment that cost money, so I spent money on those cars as an entertainment option. At the time I could afford that kind of entertainment. The day came when I couldn't. Today I could again, but I choose to spend my money on things that will be more practical and that will make me money. And lastly, I should add, that sometimes the excuse is given (as I did to myself) that I "need" a very nice car for the sake of my business. That is rubbish. A client can be just as comfortable in my car as he ever would have been in a Cadillac. And if he's the type client that I need to impress, then I've decided that I'd just as soon not have clients like that.

You lack diversification: There is a reason one of the oldest pieces of financial advice is to not keep all your eggs in a single basket. Having a diversified investment portfolio makes it much less likely that wealth will suddenly disappear. It also helps you to see if one basket is going rotten you can dump it without contaminating or spoiling the other baskets.

You started too late: The magic of compound interest works best over long periods of time. If you find you're always saying there will be time to save and invest in a couple more years, you'll wake up one day to find retirement is just around the corner and there is still nothing in your retirement account. It would still be better to save 500.00 a month for 5 years, than it would be to save nothing for 30 years.

You don't do what you enjoy: While your job doesn't necessarily need to be your dream job, you need to enjoy it. If you choose a job you don't like just for the money, you'll likely spend all that extra cash trying to relieve the stress of doing work you hate. Many have been critical of me in because I've been a printer, a salesman, a school principal, a cotton broker, a builder and a hotel operator. It seems to a lot of people that I'm still trying to figure out what I want to be when I grow up. But the fact is that if something stops being fun, or I find something else to do that might be more fun than what I'm doing . . . . or more prosperous . . .I will get up and make a change. I have loved practically every job I've ever done.

You don't like to learn: You may have assumed that once you graduated from high school or college, there was no need to study or learn. That attitude might be enough to get you your first job or keep you employed, but it will never make you rich. A willingness to learn to improve your career and finances are essential if you want to eventually become wealthy. I flunked out of college for lack of enthusiasm and desire. But it didn't mean I didn't want to learn. I just didn't want to go to college. And even if you can't read well, or don't enjoy reading, you can watch the Discovery Channel or the History Channel, or The Learning Channel and learn more about life and how things work. But if you sit around watching the Simpson's, then you can simply expect to go through life as a cartoon character yourself.

You buy things you don't use: Take a look around your house, in the closets, basement, attic and garage and see if there are a lot of things you haven't used in the past year. If there are, chances are that all those things you purchased were wasted money that could have been used to increase your net worth. I personally think that if I look at something and can't remember using it in the past two years, that I don't need it. I can't see a reason to own more than six dress shirts, six sport shirts and six pair of pants. Three pair of shoes is plenty and anything else is excess. If you're hanging around friends that you feel would not think well of you for having a limited wardrobe, then you should get some new friends. Being "stylish" is about one of the silliest waste of money I can imagine. Take the money from buying a large wardrobe and invest it into something that will make you more money where you can achieve a point of not having to work as much. I just got back from the cobbler today a pair of shoes that I've owned for 15 years. I love those shoes and have had them repaired and resoled many times in those years. Today my bill was 62.00 to have them look brand new all over again and now they'll last me two or three more years. That's a cheap price for a pair of great shoes.

You don't understand value: You buy things for any number of reasons besides the value that the purchase brings to you. This is not limited to those who feel the need to buy the most expensive items, but can also apply to those who always purchase the cheapest goods. Rarely are either the best value, and it's only when you learn to purchase good value that you have money left over to invest for your future. And I'm not saying you can't have expensive things. If it brings you a value, either financially or mentally or emotionally, then it could be worth every penny of what you paid for it. But if you bought something just because it was the "designer" name then it was extravagance. (PS. I do own one Armani suit. It was extravagance. It's not much better than a $800.00 suit. But it is better. Its a great suit. And I like the way it hangs on me. I like the feel of the fabric. But it was still extravagance.) I regretted wasting the money on it ten days after I bought it. If I had put that $2,500.00 into my business ten years ago, I'd have $7,500.00 more in the bank today and could buy a closet full of suits if I wanted. I could even buy a modest suit every year off the interest that I made on the money I had saved by not buying it. In general . . .it was one of the dumbest decisions of my life.

Your house is too big: When you buy a house that is bigger than you can afford or need, you end up spending extra money on longer debt payments, increased taxes, higher upkeep and more things to fill it. Some people will try to argue that the increased value of the house makes it a good investment, but the truth is that unless you are willing to downgrade your living standards, which most people are not, it will never be a liquid asset or money that you can ever use and enjoy. Find a house that meets your needs and then buy that house. But try to find on that just meets your needs and provides your family a level of comfort and safety that will make the house and asset to your living standard and not a distraction. Or in some cases, you can rent cheaper and invest the difference. That can make sense too.

You fail to take advantage of opportunities: There has probably been more than one occasion where you heard about someone who has made it big and thought to yourself, "I could have thought of that." There are plenty of opportunities if you have the will and determination to keep your eyes open. I myself, have a tendency to consider new ideas and wonder to myself "well, if it was a great idea why hasn't someone else already done it?". And the answer is simply that maybe no one else has thought of it.

That's it for tonight. I'll write more later girls as I remember them. For a broader perspective on wealth, read back a few weeks to the letter from the employer to his employees about the Stimulus checks and taxation and redistribution of wealth.

You feel entitlement: If you believe you deserve to live a certain lifestyle, have certain things and spend a certain amount before you have earned to live that way, you will have to borrow money. That large chunk of debt will keep you from building wealth. The world, the government, your boss, and no one else owes you a thing. With the rare exception of a few folks who inherited wealth, most people who have more than you have worked harder, saved more, and spent smarter than you have. Take some responsibility for youself and make a decision to do something to move forward. A man, who was one time appreciating a house that I was building (and paying cash for) told me that he wished he could have a house someday like mine. I asked him why he didn't think he would. And he said "are you crazy? I could never have enough money to have a house like this.". I told him that wasn't the problem. The problem was that he wasn't willing to "pay the price". And the price was not measured in $$$$. The price was measured in the fact that I was willing to work 50 or 55 or 60 hours a week to earn extra money to pay cash for something. Whereas he was primarily focused on how soon 5 o'clock would arrive so that he could get off and go get a beer. I deserved the house I was building. He didn't.

You care what your car looks like: A car is a means of transportation to get from one place to another, but many people don't view it that way. Instead, they consider it a reflection of themselves and spend money every two years or so to feel better about themselves or to impress others instead of driving the car for its entire useful life and investing the money saved. I drive a seven year old nice car that still runs wonderful, is very comfortable, and has 145,000 miles on it. My car payment is zero and I am just as comfortable in it as I would be in a car that was new or that I was making payments on. A car . . .unless it is a collector or toy . . .has no value other than to get you from Point A to Point B and perhaps to do it in some measure of comfort. Most cars lose money every day that you own them. Now . . I am not throwing stones at anyone. I have had nice cars before. But I wish now I had the money back that I lost on owning them. They didn't get me anywhere I was wanting to go any faster or more comfortably than the 7 year old Toyota I have now. I've also had two expensive collector cars that were sports cars. I did not buy them for status. I bought them for fun. I don't do many other things for entertainment that cost money, so I spent money on those cars as an entertainment option. At the time I could afford that kind of entertainment. The day came when I couldn't. Today I could again, but I choose to spend my money on things that will be more practical and that will make me money. And lastly, I should add, that sometimes the excuse is given (as I did to myself) that I "need" a very nice car for the sake of my business. That is rubbish. A client can be just as comfortable in my car as he ever would have been in a Cadillac. And if he's the type client that I need to impress, then I've decided that I'd just as soon not have clients like that.

You lack diversification: There is a reason one of the oldest pieces of financial advice is to not keep all your eggs in a single basket. Having a diversified investment portfolio makes it much less likely that wealth will suddenly disappear. It also helps you to see if one basket is going rotten you can dump it without contaminating or spoiling the other baskets.

You started too late: The magic of compound interest works best over long periods of time. If you find you're always saying there will be time to save and invest in a couple more years, you'll wake up one day to find retirement is just around the corner and there is still nothing in your retirement account. It would still be better to save 500.00 a month for 5 years, than it would be to save nothing for 30 years.

You don't do what you enjoy: While your job doesn't necessarily need to be your dream job, you need to enjoy it. If you choose a job you don't like just for the money, you'll likely spend all that extra cash trying to relieve the stress of doing work you hate. Many have been critical of me in because I've been a printer, a salesman, a school principal, a cotton broker, a builder and a hotel operator. It seems to a lot of people that I'm still trying to figure out what I want to be when I grow up. But the fact is that if something stops being fun, or I find something else to do that might be more fun than what I'm doing . . . . or more prosperous . . .I will get up and make a change. I have loved practically every job I've ever done.

You don't like to learn: You may have assumed that once you graduated from high school or college, there was no need to study or learn. That attitude might be enough to get you your first job or keep you employed, but it will never make you rich. A willingness to learn to improve your career and finances are essential if you want to eventually become wealthy. I flunked out of college for lack of enthusiasm and desire. But it didn't mean I didn't want to learn. I just didn't want to go to college. And even if you can't read well, or don't enjoy reading, you can watch the Discovery Channel or the History Channel, or The Learning Channel and learn more about life and how things work. But if you sit around watching the Simpson's, then you can simply expect to go through life as a cartoon character yourself.

You buy things you don't use: Take a look around your house, in the closets, basement, attic and garage and see if there are a lot of things you haven't used in the past year. If there are, chances are that all those things you purchased were wasted money that could have been used to increase your net worth. I personally think that if I look at something and can't remember using it in the past two years, that I don't need it. I can't see a reason to own more than six dress shirts, six sport shirts and six pair of pants. Three pair of shoes is plenty and anything else is excess. If you're hanging around friends that you feel would not think well of you for having a limited wardrobe, then you should get some new friends. Being "stylish" is about one of the silliest waste of money I can imagine. Take the money from buying a large wardrobe and invest it into something that will make you more money where you can achieve a point of not having to work as much. I just got back from the cobbler today a pair of shoes that I've owned for 15 years. I love those shoes and have had them repaired and resoled many times in those years. Today my bill was 62.00 to have them look brand new all over again and now they'll last me two or three more years. That's a cheap price for a pair of great shoes.

You don't understand value: You buy things for any number of reasons besides the value that the purchase brings to you. This is not limited to those who feel the need to buy the most expensive items, but can also apply to those who always purchase the cheapest goods. Rarely are either the best value, and it's only when you learn to purchase good value that you have money left over to invest for your future. And I'm not saying you can't have expensive things. If it brings you a value, either financially or mentally or emotionally, then it could be worth every penny of what you paid for it. But if you bought something just because it was the "designer" name then it was extravagance. (PS. I do own one Armani suit. It was extravagance. It's not much better than a $800.00 suit. But it is better. Its a great suit. And I like the way it hangs on me. I like the feel of the fabric. But it was still extravagance.) I regretted wasting the money on it ten days after I bought it. If I had put that $2,500.00 into my business ten years ago, I'd have $7,500.00 more in the bank today and could buy a closet full of suits if I wanted. I could even buy a modest suit every year off the interest that I made on the money I had saved by not buying it. In general . . .it was one of the dumbest decisions of my life.

Your house is too big: When you buy a house that is bigger than you can afford or need, you end up spending extra money on longer debt payments, increased taxes, higher upkeep and more things to fill it. Some people will try to argue that the increased value of the house makes it a good investment, but the truth is that unless you are willing to downgrade your living standards, which most people are not, it will never be a liquid asset or money that you can ever use and enjoy. Find a house that meets your needs and then buy that house. But try to find on that just meets your needs and provides your family a level of comfort and safety that will make the house and asset to your living standard and not a distraction. Or in some cases, you can rent cheaper and invest the difference. That can make sense too.

You fail to take advantage of opportunities: There has probably been more than one occasion where you heard about someone who has made it big and thought to yourself, "I could have thought of that." There are plenty of opportunities if you have the will and determination to keep your eyes open. I myself, have a tendency to consider new ideas and wonder to myself "well, if it was a great idea why hasn't someone else already done it?". And the answer is simply that maybe no one else has thought of it.

That's it for tonight. I'll write more later girls as I remember them. For a broader perspective on wealth, read back a few weeks to the letter from the employer to his employees about the Stimulus checks and taxation and redistribution of wealth.

Tuesday, April 14, 2009

facts bout Texas

Here are some little known, very interesting facts about Texas . 1. Beaumont to El Paso : 742 miles 2.. Beaumont to Chicago : 770 miles 3... El Paso is closer to California than to Dallas 4. World's first rodeo was in Pecos , July 4, 1883. 5. The Flagship Hotel in Galveston is the only hotel in North America built over water. 6. The Heisman Trophy was named after John William Heisman who was the first full-time coach at Rice University in Houston . 7. Brazoria County has more species of birds than any other area in North America 8. Aransas Wildlife Refuge is the winter home of North America 's only remaining flock of whooping cranes. 9. Jalapeno jelly originated in Lake Jackson in 1978. 10. The worst natural disaster in U.S. history was in 1900, caused by a hurricane, in which over 8,000 lives were lost on Galveston Island . 11. The first word spoken from the moon, July 20,1969, was " Houston ," but the space center was actually in Clear Lake City at the time. 12. King Ranch in South Texas is larger than Rhode Island .. 13. Tropical Storm Claudette brought a U.S. rainfall record of 43" in 24 hours in and around Alvin in July of 1979... 14. Texas is the only state to enter the U.S. by TREATY, (known as the Constitution of 1845 by the Republic of Texas to enter the Union ) instead of by annexation. This allows the Texas Flag to fly at the same height as the U.S. Flag, and may divide into 5 states. 15. A Live Oak tree near Fulton is estimated to be 1500 years old. 16. Caddo Lake is the only natural lake in the state. 17. Dr Pepper was invented in Waco in 1885. There is no period in Dr Pepper.. 18. Texas has had six capital cities: Washington -on- the Brazos, Harrisburg , Galveston ,Velasco, West Columbia and Austin .. 19. The Capitol Dome in Austin is the only dome in the U.S. which is taller than the Capitol Building in Washington DC (by 7 feet). 20. The San Jacinto Monument is the tallest free standing monument in the world and it is taller than the Washington monument. 21. The name ' Texas ' comes from the Hasini Indian word 'tejas' meaning friends. Tejas is not Spanish for Texas .. 22. The State Mascot is the Armadillo (an interesting bit of trivia about the armadillo is they always have four babies. They have one egg, which splits into four, and they either have four males or four females.). 23. The first domed stadium in the U.S. was the Astrodome in Houston

Sunday, April 12, 2009

Friday, April 10, 2009

An Amusing Puppeteer

I thought this was cute. And certainly an interesting twist on playing with life size puppets.

Wednesday, April 1, 2009

April 1. Splash Day

Besides being a day for playing jokes on people, April 1st of the year means for me the day I get to take my boat back out of the marina. My insurance policy requires that I "lay up" from November 1 through March 31st. And that simply means that the boat can not be moved away from it's mooring during the winter months. Plus the fact that it gets cold enough up here in Northeast Oklahoma that I have to remove all the fluids from the boat and winterize it. Of course that makes it difficult to spend any evenings on it during the winter since there is no running water while it's "laid up". But the last week in March, marks the time of the year for getting her ready to take back out again. And April 1st is the day to start the engines and take her down river for a bit and check the systems out.

This year I am considering taking the Island Girl all the way down the Arkansas River to the Mississippi and then going on south to New Orleans. If I do go, I'm not sure if I'll turn and head toward Houston and Corpus Christi or whether I make take her down to the Florida Keys. But way, I intend to take things more easy this summer and spend a lot of time on the way.

Subscribe to:

Comments (Atom)